| Home » Categories » Solutions by Business Process » Finance » Sales and Purchase Ledgers |

Check a UK VAT Number |

|

Article Number: 2298 | Rating: Unrated | Last Updated: Wed, Oct 23, 2024 at 11:48 AM

|

|

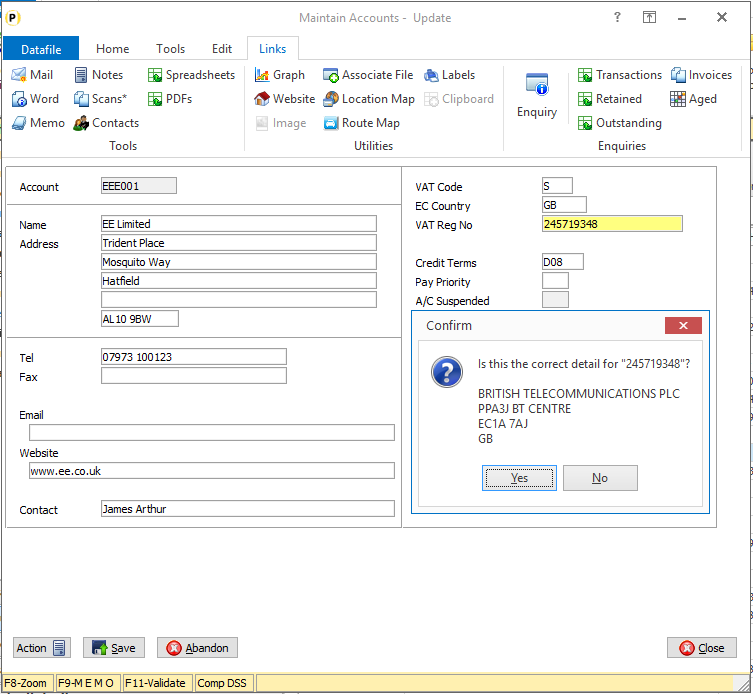

This new option allows you to validate the VAT Registration Number that you receive from UK customers and suppliers against HMRC records. Applicable for users who have registered their Datafile software application for the submission of VAT Form 100 details this new option allows you to key <F11-Validate> on the VAT Registration and shows the details the HMRC hold for that customer/supplier.

Installation

This option is available immediately on update.

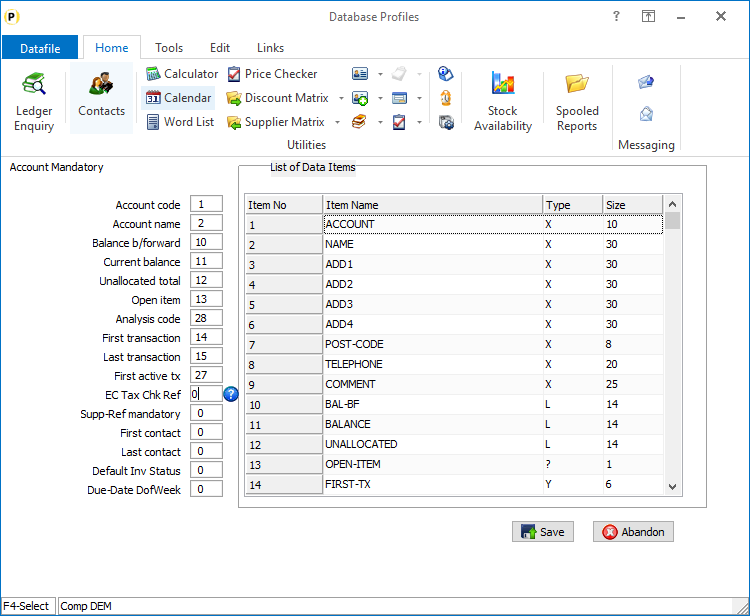

However, an additional option, available for Diamond and Premier users, allows you to save a HMRC reference number to the record to indicate you have validated the VAT Registration for the customer / supplier. Database Changes Changes are required to the Sales/Purchase Accounts to record the check reference. To add these items, select Installation from the main menu followed by Application Manager and then Restructure a Database. Select the Sales/Purchase Ledger application and elect to update the Live Files and then select the appropriate application file. To insert a new item press <Enter> against a blank entry, enter the title as required and press <Enter>, select the item type (using the drop-down list if required), and depending on item type select the size required. File Item Name Type Description SLA/PLA VAT-CHECK-NO X (20) Holds the HMRC VAT Check Reference. Once the required items have been recorded press the <ESC> key and select the UPDATE button to save the database changes. When prompted respond ‘Y’ to the prompts to ‘Extract Existing Data to New Database Structure’ and, if appropriate, ‘Copy Table Entries from Old Database to New Database’. Final prompts ask to ‘Remove (.OLD) Database’ and to ‘Carry Out the Same Restructure on the BASE File as well’ – respond as required. If you select to update the base file you need to manually insert the new items at the same data item positions as on the live file. Set Database Profiles The new reference item for the sales/purchase account are referenced via the Database Profiles. To update select Installation from the main menu followed by Application Manager and Set Database Profiles.

The new Tax Ref Check item is referenced on the Account Mandatory parameter screen. |

Attachments

There are no attachments for this article.

|

Allow Insert of Lines within Order by Status

Viewed 2167 times since Thu, Jan 2, 2025

Write Off Bad Debts

Viewed 2666 times since Mon, Jul 2, 2012

Aged Analysis – Select to Age on Invoice or Due Date

Viewed 220 times since Wed, Oct 16, 2024

Account Currency - Database Profiles

Viewed 2383 times since Mon, Jul 2, 2012

Transaction / Detail Enquiries

Viewed 14284 times since Mon, Jul 2, 2012

VAT Adjustments - VAT on Imported Goods

Viewed 6465 times since Fri, Oct 12, 2018

Increased Number of Entries in Allocations

Viewed 2389 times since Fri, Jun 8, 2012

Sales/Purchase Document Facilities

Viewed 2469 times since Mon, Jul 2, 2012

Additional Features on Transaction Look-Up (P/L only)

Viewed 2604 times since Wed, Jun 13, 2012

Turnover Analysis

Viewed 2400 times since Mon, Jul 2, 2012

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|