| Home » Categories » Solutions by Business Process » Finance » Sales and Purchase Ledgers |

Transfer Outstanding Balances |

|

Article Number: 2169 | Rating: Unrated | Last Updated: Fri, Jun 16, 2023 at 4:44 PM

|

|

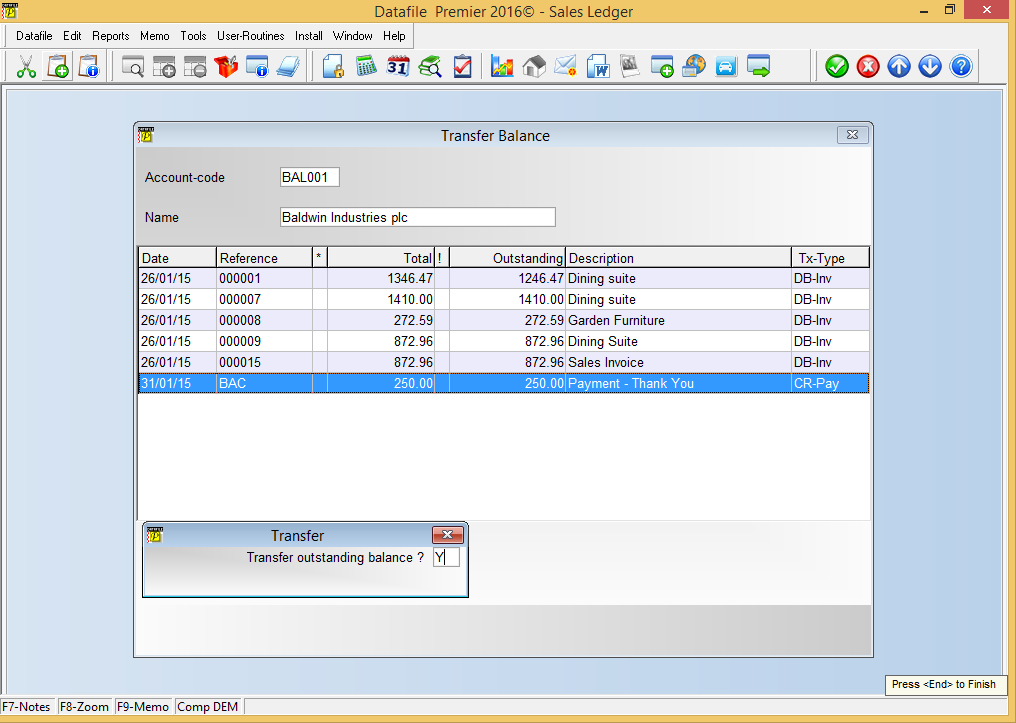

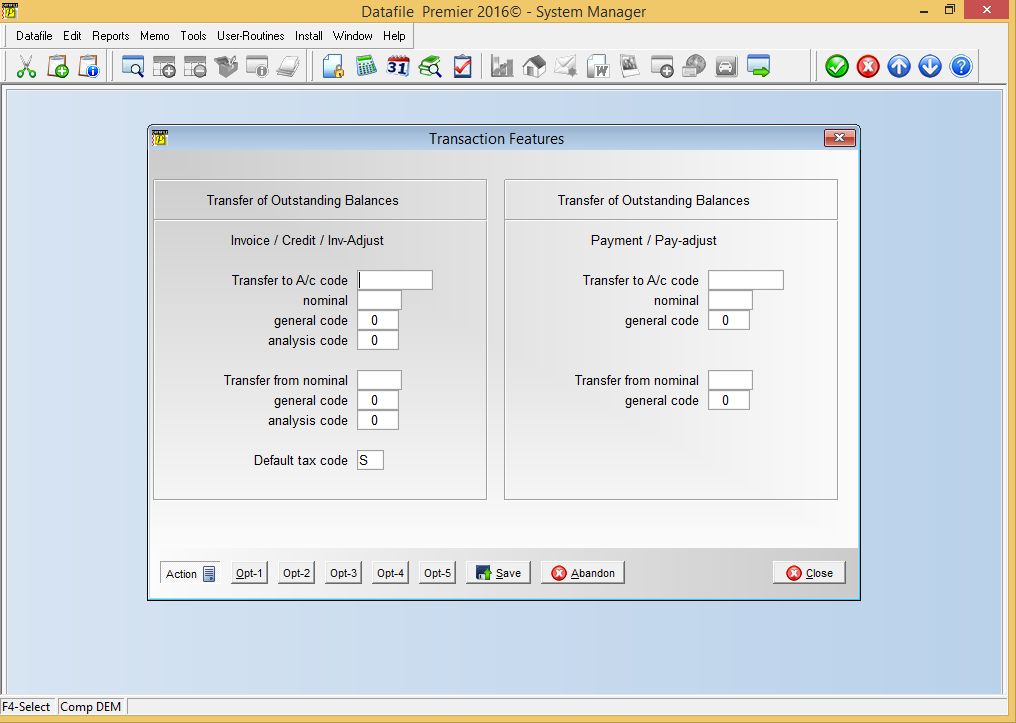

Diamond and Premier only The Sales / Purchase Utilities option allows the facility to transfer invoice balances between accounts, this option has now been extended to allow for the transfer of payments, credits, invoice adjustments and payment adjustment transactions. Selecting to transfer a credit note or invoice adjustment operates in the same manner as an invoice – asking for the transfer amount, then confirming the transfer VAT code, the amount (and VAT amount) plus the transfer ‘to’ account code before asking to confirm the new transaction due date, reference and description. As part of the transfer the system will apply the nominal/analysis defaults set within the Application User Facilities. The transfer of the Credit / Invoice Adjustment will create an invoice on the ‘from’ account and the credit / invoice adjustment on the ‘to’ account. Selecting to transfer a payment or payment adjustment operates in a similar manner – asks for the transfer amount, the new account code and to confirm the new transaction reference and description. The transfer of a payment will create a payment adjustment on the ‘from’ account and a new payment transaction on the ‘to’ account, with the reverse if transfer a payment adjustment. InstallationApplication User FacilitiesThe ability to transfer payments etc. is enabled automatically on update to Release 6.9 / 2016 but you may wish to review the default nominal and analysis values for invoices and set transfer values for the payments. To update Installer users can right-click on the menu option for Transfer Outstanding Balancesand select the ‘Configure Option’ facility and move to screen 2 of the parameters. Alternatively you can selectInstallation from the main menu followed by Application Manager and then Application User Facilities. Select the required application before selecting Sales/Purchase Transactionsand move to screen 2 of the parameters.

Invoice / Credits / Invoice Adjustments Transfer to A/C Code – set default account code for transfer to (this may be useful where transactions are raised to the customer / supplier but processed for payment by a third-party. Transfer to/from Nominal Code – select the nominal code to be used for the transfer transactions. You can use different accounts for the from/to entry but it is usual to reference the same account, typically a suspense account. Transfer to/from General Code – where not using a Nominal Ledger set the transfer from/to general code. Transfer to/from Analysis Code – set the analysis code to be used for the from/to transactions. Default Tax Code – set the tax code to be offered by default for transfer – usually set to standard rate. Note as the transfer creates a zero net effect on the VAT liability then the VAT amount is used for ‘memo’ purposes only. Payments / Payment Adjustments Transfer to A/C Code – set default account code for transfer if required. Transfer to/from Nominal Code – select the nominal code to be used for the transfer transactions. You can use different accounts for the from/to entry but it is usual to reference the same account. This would typically be a contra or suspense account. Transfer to/from General Code – where not using a Nominal Ledger set the transfer from/to general code. |

Attachments

There are no attachments for this article.

|

Set Transaction Status Flags - Sales Ledger

Viewed 2145 times since Mon, Jul 2, 2012

Changes to File Locking on Save Aged Analysis

Viewed 2512 times since Tue, Jun 12, 2012

Enter Credit Notes

Viewed 2740 times since Mon, Jul 2, 2012

Sub-Contractor Accessory - Transaction Entry

Viewed 2500 times since Mon, Jul 2, 2012

Account Statements - Application User Facilities

Viewed 2437 times since Mon, Jul 2, 2012

Moving, Deleting and Amending Items - Document Design Manager

Viewed 2660 times since Mon, Jul 2, 2012

Account Optional 2 - Database Profiles

Viewed 2619 times since Mon, Jul 2, 2012

Audit Pointers and Balances

Viewed 2581 times since Mon, Jul 2, 2012

Credit Control Manager (S/L Only)

Viewed 29300 times since Wed, Jun 13, 2012

VAT Form 100 - Group VAT Registration

Viewed 5369 times since Tue, Oct 9, 2018

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|