| Home » Categories » Solutions by Business Process » Finance » Payroll |

Benefits in Kind / Company Cars |

|

Article Number: 2196 | Rating: Unrated | Last Updated: Fri, Jun 16, 2023 at 4:24 PM

|

|

From the start of the 2016/17 tax year employers could choose to account for the tax on benefits in kind through PAYE each payday. For more details review the HMRC website at: https://www.gov.uk/guidance/paying-your-employees-expenses-and-benefits-through-your-payroll

In summary this option increases the employees ‘taxable pay’ to include the benefit in kind rather than the HMRC reducing the employees tax code and avoids the need, in some circumstances, to submit a P11D.

From 17/18 you now have the option to record company car details against a nominated benefit in kind. Recording these details is optional currently, even if you have chosen to payroll Benefits in Kind, though is likely to become mandatory in the future.

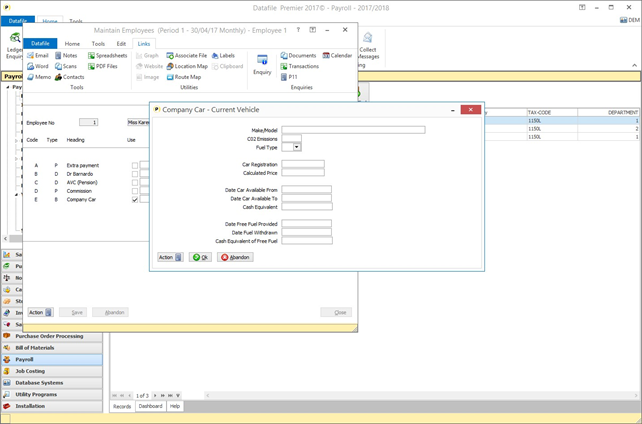

Employee Maintenance– either when adding new employees or via the Switches maintenance screen. When an employee is confirmed as using the

Company Car BiK switch a pop-up screen will allow recording of the company car

details.

Details prompted will be familiar to those used to recording these details on line via the HMRC website. If a car is withdrawn / replaced during the tax year you should update the withdrawal dates and create a new entry for the new car – up to four changes of car are supported for the employee within the tax year.

Installation

Payroll System Profiles

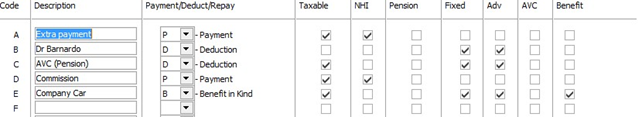

Within the Payroll System Profiles Payment and Deduction Table you can flag an extra payment switch as

being a Benefit in Kind.

if you have a Benefit in Kind switch which is used for Company Car’s note the letter (number) and then set this

|

Attachments

There are no attachments for this article.

|

Payment Adjustment Analysis

Viewed 3620 times since Tue, Mar 26, 2013

Employee Optional 10/11

Viewed 2398 times since Wed, Mar 27, 2013

Ignore Records on F4 Lookup

Viewed 2411 times since Tue, Mar 26, 2013

Payroll Extra - Multiple Company Pension Schemes

Viewed 4277 times since Mon, Nov 25, 2013

Ledger Enquiry - Print Employee Calendar Entries

Viewed 4011 times since Fri, Jun 8, 2012

Cheque Payments

Viewed 2182 times since Tue, Mar 26, 2013

Employee Optional 11/11

Viewed 2484 times since Wed, Mar 27, 2013

Memo Facility Configuration

Viewed 4834 times since Tue, Mar 26, 2013

Run the Payroll

Viewed 2530 times since Wed, Mar 27, 2013

Launch Other Programs

Viewed 2506 times since Tue, Mar 26, 2013

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|