| Home » Categories » Multiple Categories |

VAT Adjustments - Post-Dated Purchase Invoices |

|

Article Number: 2212 | Rating: Unrated | Last Updated: Mon, Jun 12, 2023 at 2:19 PM

|

|

Post-Dated Purchase Invoices The Datafile Purchase Ledger allows posting to the current purchase ledger period and one future period. If you receive a purchase invoice for an earlier period that has now been closed, you can post that transaction but for Nominal and VAT purposes it’s treated as a current period transaction.

Adjustments are therefore required if the transaction needs to be posted into the original correct period for the VAT Form 100.

Option 1 – Where Real-Time Updating to the Nominal Ledger is Set

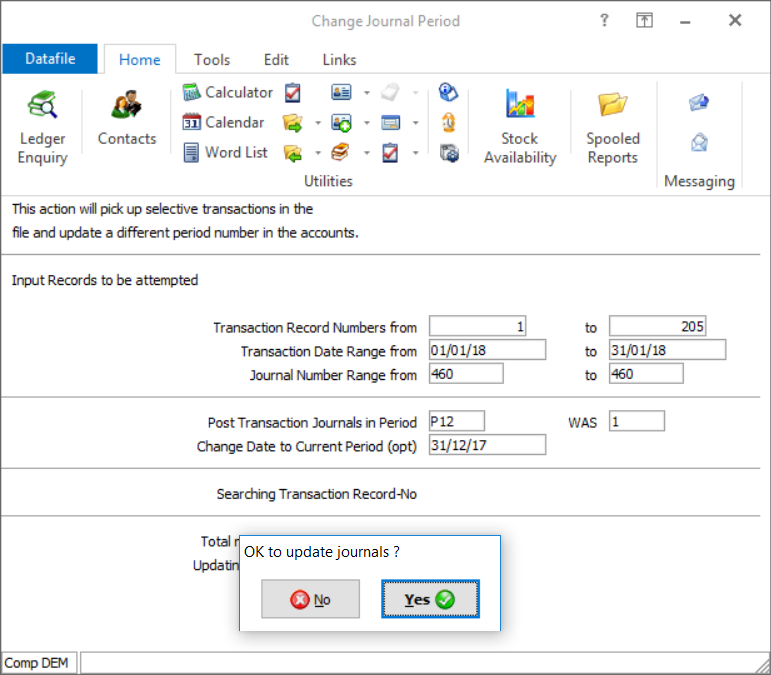

If the system is configured for real-time updating, then each purchase transaction will generate its own nominal journal. Within the Nominal Ledger – Other Journal Options, the Change Journal Period option should be used as per screenshot below:

The Change Journal Period option allows you to enter a date and journal number range and then asks you to confirm the period to adjust to and the period to adjust out.

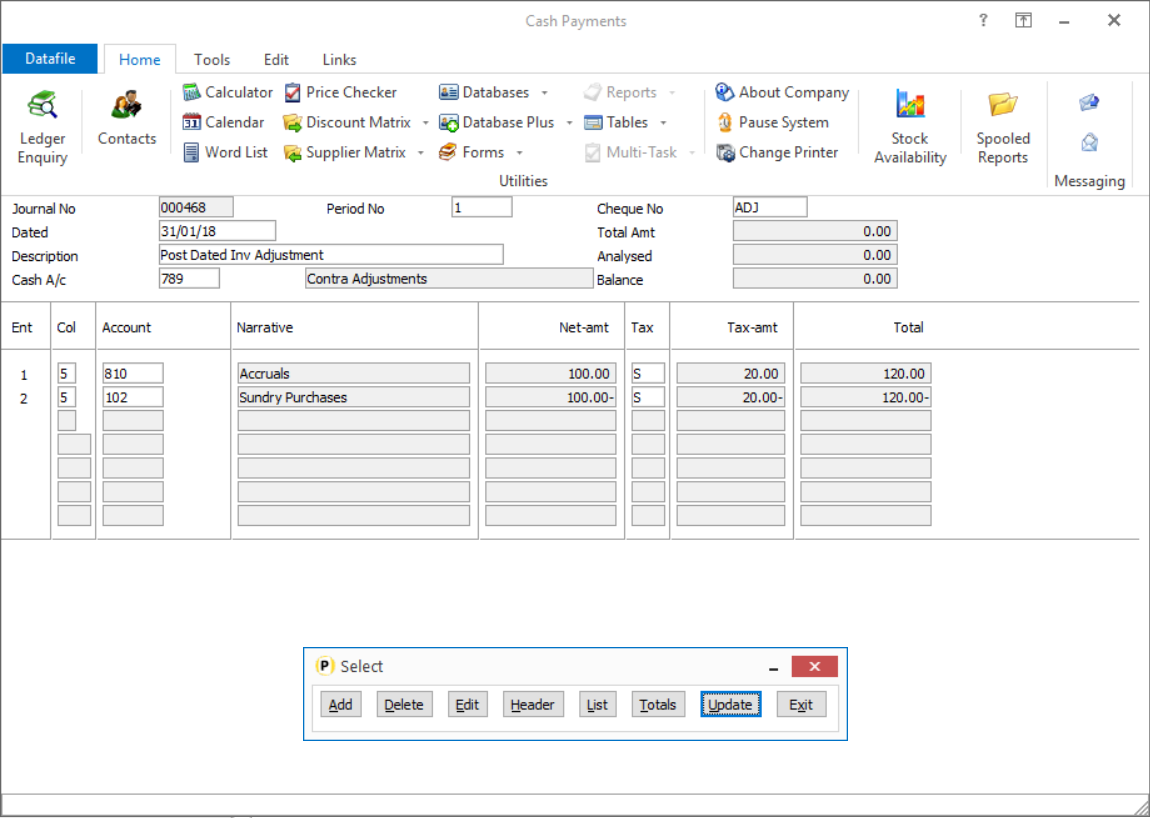

Option 2 – Where Nominal Ledger Batch Updates Are Used If batch updating to the Nominal Ledger, then it’s likely the posting will include additional transactions that should not have the period adjusted. For these, manual adjustments should be made using the Cashbook Payment processing options. The adjustment is done in two stages  Select your Contra Adjustments account as the Bank Account for the payment, and enter a zero value. On line 1 select your balance sheet Accruals account and post the goods / vat amount. On line 2 select the original nominal expense account and post identical values but with a negative goods / vat amount.

After reversing the posting you then need to re-enter to the required period – reversing the above so that the positive values post to your expense account and the negative values post to the accrual account. |

Attachments

There are no attachments for this article.

|

Include Currency Accounts in Auto-Payment Procedures

Viewed 2037 times since Fri, May 27, 2016

Trial Balance - Omit Zero Value Accounts

Viewed 1944 times since Fri, Nov 22, 2013

Nominal Analysis

Viewed 2491 times since Mon, Jul 2, 2012

System Profiles - Nominal

Viewed 2880 times since Wed, Jun 27, 2012

Transaction Summary

Viewed 2380 times since Mon, Jul 2, 2012

Edit System Status Display

Viewed 2151 times since Mon, Jul 2, 2012

Payment Column Headings - Cashbook

Viewed 2135 times since Wed, Jun 27, 2012

Multiple Updating – General Details / Which Systems Allowed - Nominal

Viewed 1248 times since Thu, Jun 28, 2012

Year End Reporting

Viewed 2253 times since Wed, Jun 13, 2012

Supplier Payments Due (Purchase Ledger)

Viewed 2119 times since Mon, Jul 2, 2012

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|