| Home » Categories » Multiple Categories |

VAT Adjustments - VAT on Imported Goods |

|

Article Number: 2214 | Rating: Unrated | Last Updated: Mon, Jun 12, 2023 at 2:36 PM

|

|

VAT on Imported Goods

When goods are purchased from a country outside the EU then import VAT may be applied. Typically, a separate invoice is supplied from the courier showing the amount of import duty and VAT due.

1. In Receipt of Form C79 when Posting

If you have received form C79 at the point of posting the courier invoice you can claim the Import VAT directly.

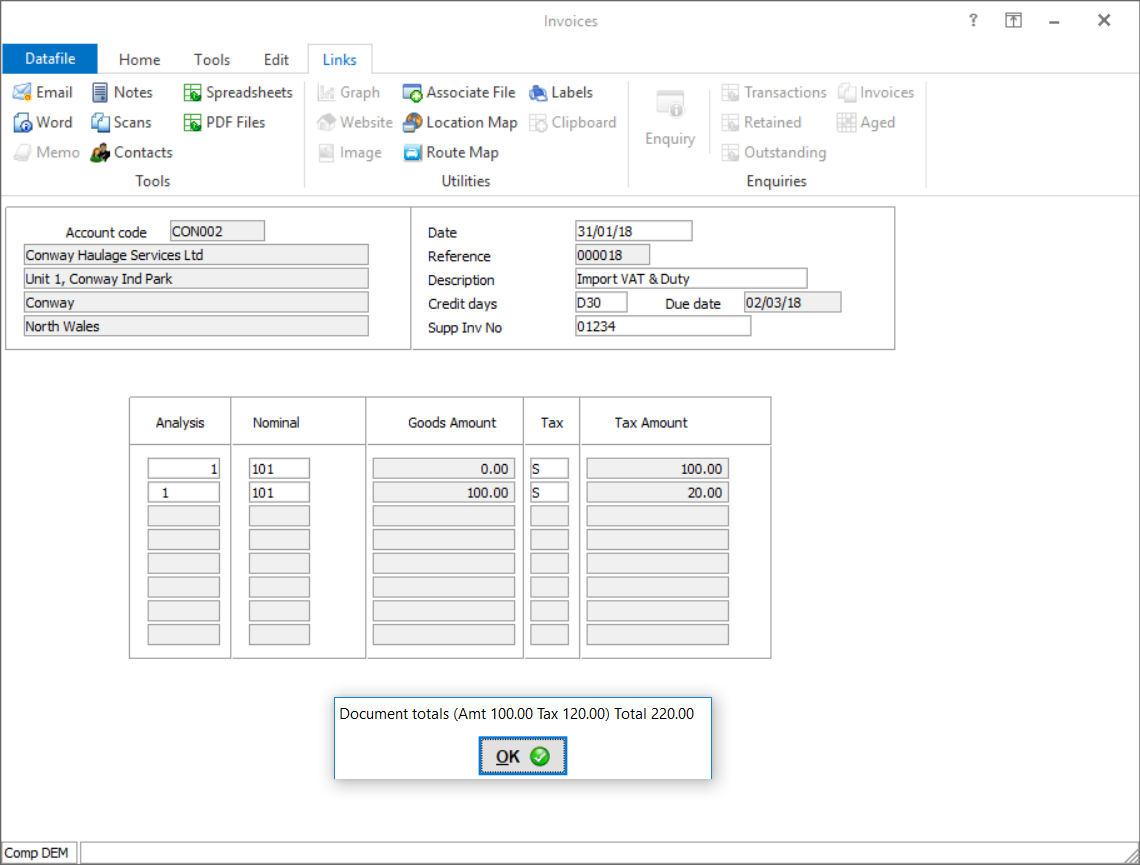

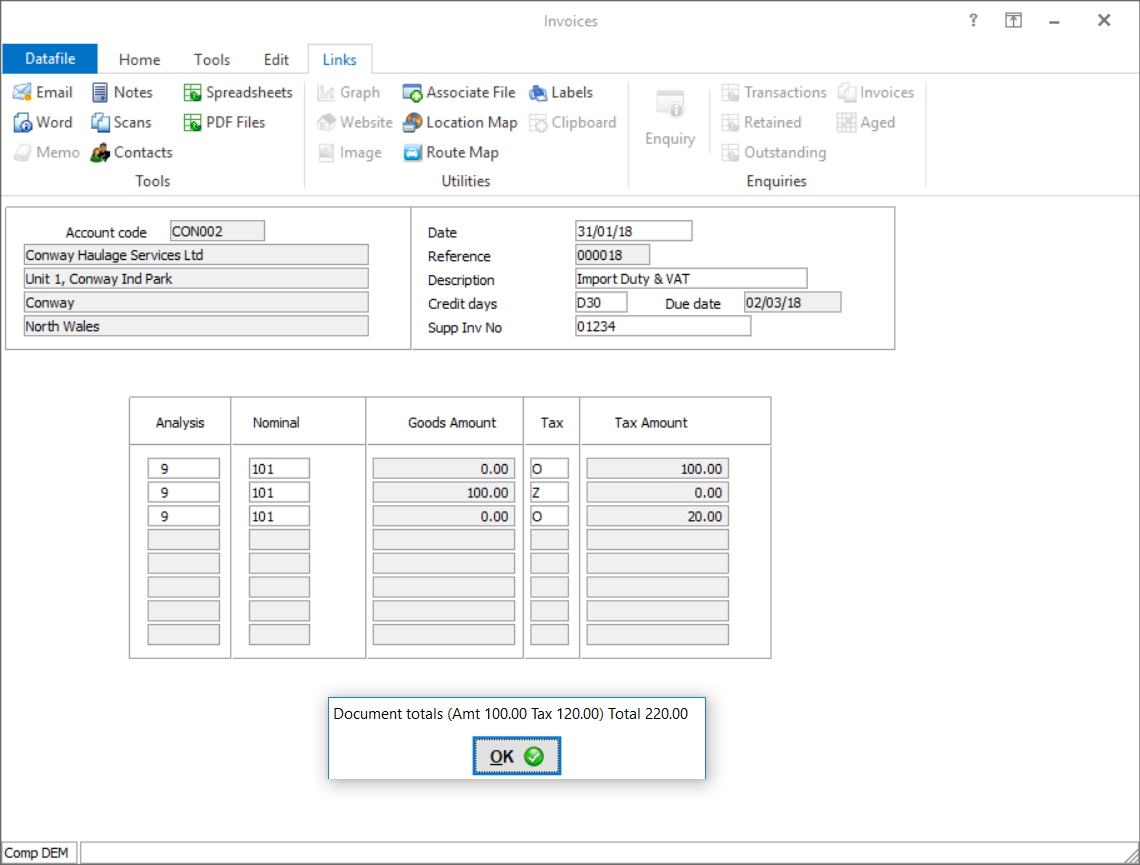

2. Not In Receipt of Form C79 when Posting If you there’s no corresponding form C79 at the point of posting, you cannot initially claim the Import VAT so the invoice should be posted accordingly using Out of Scope VAT codes where appropriate.

The use of the Out of Scope VAT code prevents the VAT being reclaimed on your VAT Form 100 for Import VAT and Duty.

3. Form C79 Form Received After Posting

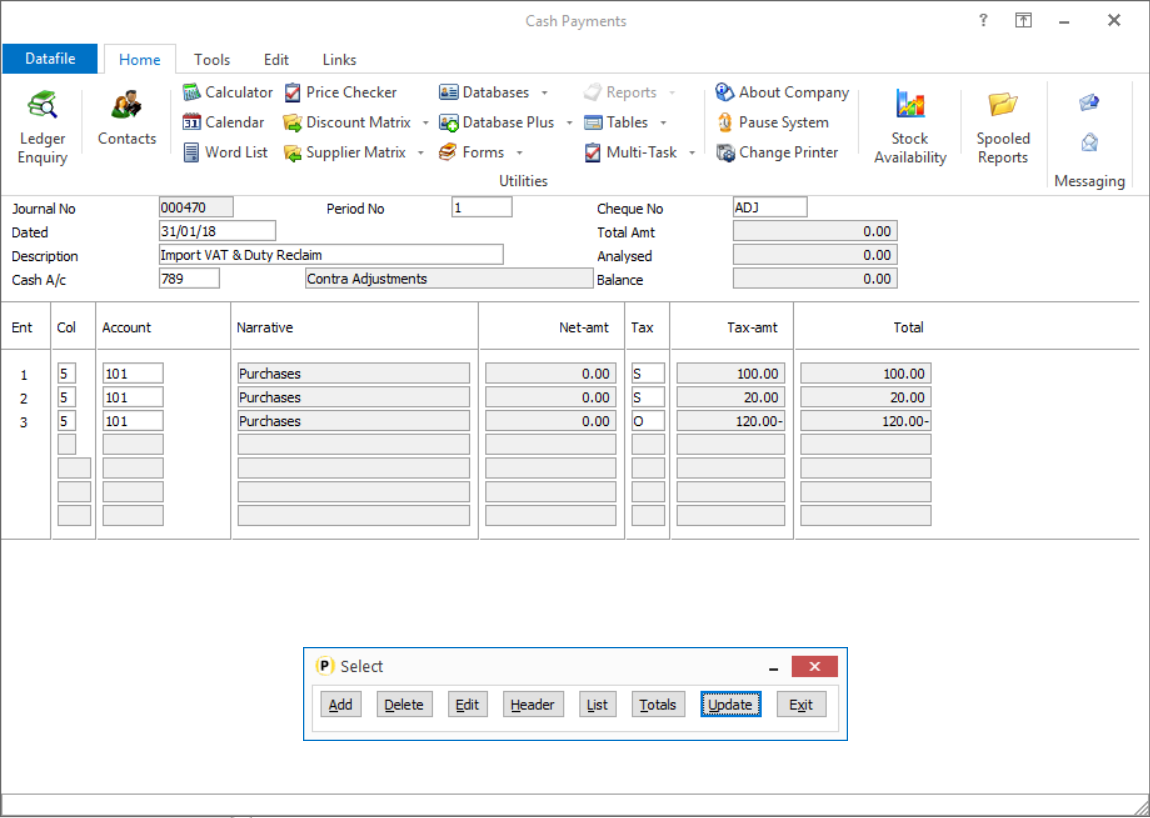

If you later receive your C79 certificate you can reclaim the Import and Duty VAT using the Cashbook Payment option.

In the Cash A/C box, select the Contra / Adjustments account and enter a zero value in the Total-Amt box.

On line 1 select the relevant expense account, then enter the Import VAT value as zero in the Net-Amt box, the relevant VAT code in the Tax box, and the actual reclaimed VAT amount in the Tax-Amt box.

One line 2 repeat the process for the reclaimed Duty VAT.

One Line 3 Reverse the Out of Scope Purchase Invoice posting by selecting the expense account, entering the Out of Scope VAT code and then setting the VAT amount as the negative equivalent of the Import and Duty VAT. |

Attachments

There are no attachments for this article.

|

YEAR-TOTALS – Enter Comparative Year Totals - Nominal

Viewed 1147 times since Wed, Jun 27, 2012

Save Statement Balance to Account / Transactions

Viewed 2145 times since Fri, Oct 26, 2012

NAMES – New/Amend Account Names - Nominal

Viewed 1513 times since Wed, Jun 27, 2012

Account Audit Trail, Account Audit Trail (Currency) - Nominal

Viewed 1715 times since Wed, Jun 27, 2012

VAT Summary – Include Out of Scope VAT Codes

Viewed 19544 times since Tue, Oct 12, 2021

Change Account Code

Viewed 2422 times since Mon, Jul 2, 2012

Transaction / Detail Enquiries

Viewed 14090 times since Mon, Jul 2, 2012

Posting Transactions - Confirm Due Date

Viewed 555 times since Wed, Oct 16, 2024

Audit Pointers - Cashbook

Viewed 1887 times since Thu, Jun 28, 2012

Automatic Bank Reconciliation - View Bank Journal

Viewed 490 times since Wed, Oct 16, 2024

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|