| Home » Categories » Multiple Categories |

VAT Form 100 - Group VAT Registration |

|

Article Number: 2210 | Rating: Unrated | Last Updated: Mon, Jun 12, 2023 at 2:20 PM

|

|

Group VAT Registration

The Cashbook VAT Form 100 reports its entries based on Nominal Ledger transactions. In a multi company environment where companies share the same VAT registration number, these need to be consolidated to submit the VAT Form 100 via MTD.

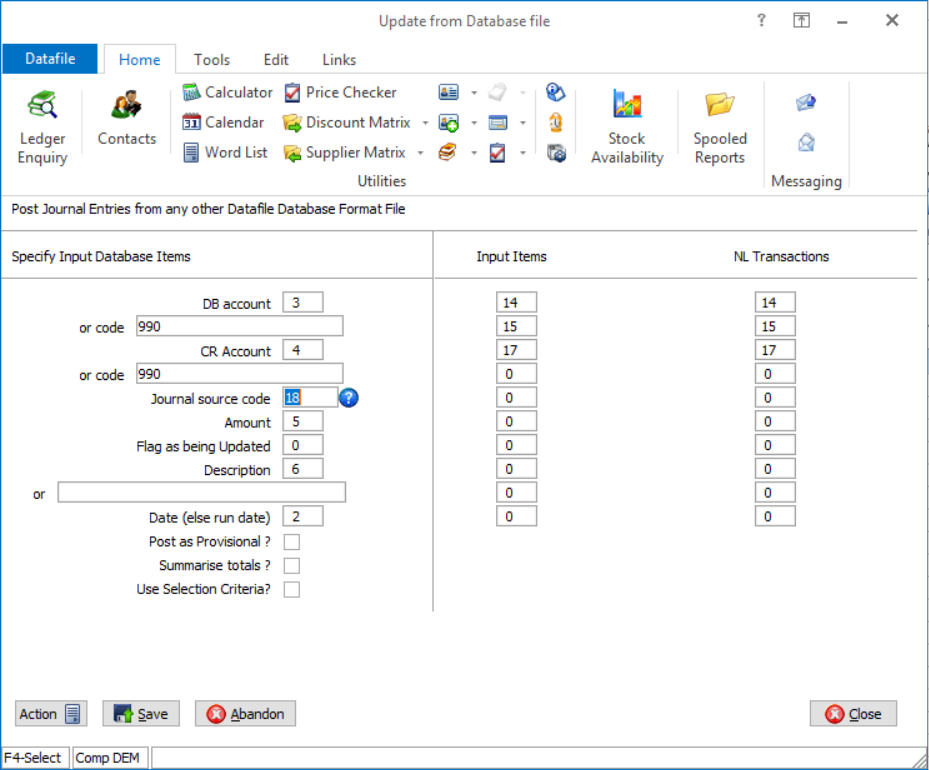

In addition to defining the Debit/Credit Accounts and Amount items, the following additional settings required so the VAT Form 100 report can be created: 1. Journal Source Code In order to be included and analysed correctly within the VAT Form 100 the source on the Nominal Journal needs to one of the following: S/L (Sales Ledger) P/L (Purchase Ledger) CBR (Cashbook Receipts) CBP (Cashbook Payments) Instead of entering a journal source as text, you should reference the data item number of the import file that contains the original journal source as per screenshot above. 2. Copy Items The other key elements for building the VAT Form 100 are the Cash-Net, Cash-Tax and Tax Code data items on the nominal transaction file. Copy items should be set from the source DFD table to the company Nominal Ledger Transaction table to update these fields. |

Attachments

There are no attachments for this article.

|

Revalue All Nominal Accounts - Nominal

Viewed 1796 times since Wed, Jun 27, 2012

Allow Insert of Lines within Order by Status

Viewed 2163 times since Thu, Jan 2, 2025

Trans Optional 2 - Database Profiles

Viewed 2372 times since Mon, Jul 2, 2012

Account Audit Trail, Account Audit Trail (Currency) - Nominal

Viewed 1852 times since Wed, Jun 27, 2012

Change Account Code

Viewed 2540 times since Mon, Jul 2, 2012

Credit Control Manager (S/L Only)

Viewed 29294 times since Wed, Jun 13, 2012

Set Transaction Status Flags - Sales Ledger

Viewed 2141 times since Mon, Jul 2, 2012

Expand Data Files - Cashbook

Viewed 1869 times since Thu, Jun 28, 2012

Automatic Postings - Cashbook

Viewed 2009 times since Wed, Jun 27, 2012

Additional Options on Supplier Payment Report

Viewed 3077 times since Tue, Jun 12, 2012

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|