| Home » Categories » Multiple Categories |

Payroll FAQ - Claiming The Employer Allowance |

|

Article Number: 2419 | Rating: Unrated | Last Updated: Thu, Aug 21, 2025 at 9:12 PM

|

|

How Do I Claim My Employer Allowance From The HMRC

To claim the employer allowance you need to submit an

Employer Payment Summary (EPS). You generally only have to submit an EPS if you are claiming back any statutory

payments (SMP etc.) or if you’re eligible to pay the Apprenticeship Levy but

you also have to submit an EPS to claim the Employer Allowance.

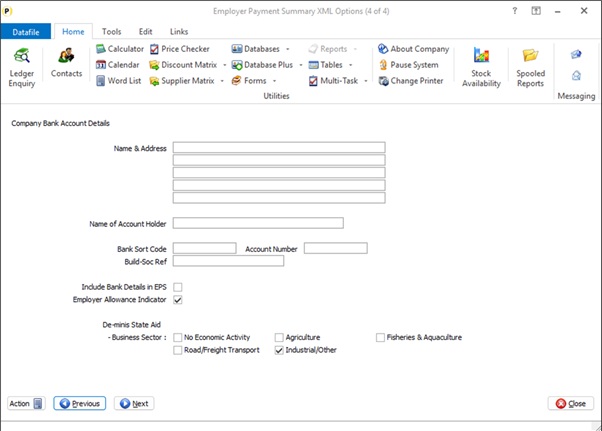

The process for submitting an EPS is similar to that of the FPS – as part of the submission you can set the ‘Employer Allowance Indicator’ and also set your state aid business sector.

You only have to submit the EPS for a employer

allowance claim once each tax year. You

can also, if required and eligible, submit a claim for the employee allowance in

earlier tax years from Datafile – swap to the history company and submit an EPS

from there.

|

Attachments

There are no attachments for this article.

|

P11 Reports

Viewed 2889 times since Tue, Mar 26, 2013

Edit System Status Display

Viewed 2124 times since Wed, Mar 27, 2013

Run the Payroll

Viewed 2526 times since Wed, Mar 27, 2013

Copy SW to EMP (1/2) - Copy SW to EMP (2/2)

Viewed 4922 times since Wed, Mar 27, 2013

Print Payslips

Viewed 2605 times since Tue, Mar 26, 2013

Input Payroll Details

Viewed 2888 times since Tue, Mar 26, 2013

Payroll - Options for File Access and Application Security

Viewed 3961 times since Tue, Sep 22, 2020

Documents Enquiry

Viewed 4705 times since Tue, Mar 26, 2013

Document Design Manager

Viewed 2498 times since Wed, Mar 27, 2013

Employee Optional 6/11

Viewed 2436 times since Wed, Mar 27, 2013

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|