| Home » Categories » Multiple Categories |

VAT Form 100 - Group VAT Registration |

|

Article Number: 2210 | Rating: Unrated | Last Updated: Mon, Jun 12, 2023 at 2:20 PM

|

|

Group VAT Registration

The Cashbook VAT Form 100 reports its entries based on Nominal Ledger transactions. In a multi company environment where companies share the same VAT registration number, these need to be consolidated to submit the VAT Form 100 via MTD.

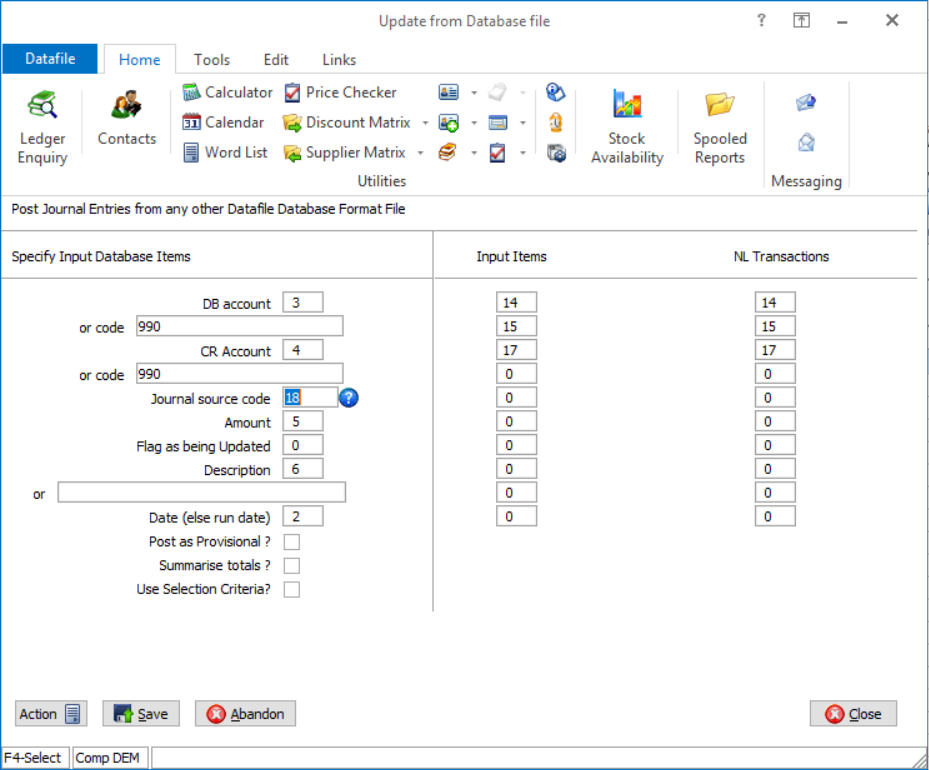

In addition to defining the Debit/Credit Accounts and Amount items, the following additional settings required so the VAT Form 100 report can be created: 1. Journal Source Code In order to be included and analysed correctly within the VAT Form 100 the source on the Nominal Journal needs to one of the following: S/L (Sales Ledger) P/L (Purchase Ledger) CBR (Cashbook Receipts) CBP (Cashbook Payments) Instead of entering a journal source as text, you should reference the data item number of the import file that contains the original journal source as per screenshot above. 2. Copy Items The other key elements for building the VAT Form 100 are the Cash-Net, Cash-Tax and Tax Code data items on the nominal transaction file. Copy items should be set from the source DFD table to the company Nominal Ledger Transaction table to update these fields. |

Attachments

There are no attachments for this article.

|

Reprint Period Invoices

Viewed 1762 times since Mon, Jul 2, 2012

Account Maintenance Improvements

Viewed 1288 times since Fri, Jun 8, 2012

Spot Rate Revaluation

Viewed 2006 times since Mon, Jul 2, 2012

Save Aged Analysis

Viewed 1526 times since Mon, Jul 2, 2012

Sales Allocations, Purchase Allocations - Cashbook

Viewed 1231 times since Wed, Jun 27, 2012

VAT Adjustments - Partial VAT Exemption Scheme

Viewed 2844 times since Thu, Oct 11, 2018

Transaction Control Numbers - Cashbook

Viewed 1181 times since Thu, Jun 28, 2012

Financial Summaries - Percentage Variance Column

Viewed 9983 times since Fri, Jun 8, 2012

Making Tax Digital – VAT Form 100

Viewed 1720 times since Fri, Jun 19, 2020

Application Screen Layouts - Nominal

Viewed 1219 times since Thu, Jun 28, 2012

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|