| Home » Categories » Solutions by Business Process » Finance » Payroll |

Benefits in Kind / Company Cars |

|

Article Number: 2196 | Rating: Unrated | Last Updated: Fri, Jun 16, 2023 at 4:24 PM

|

|

From the start of the 2016/17 tax year employers could choose to account for the tax on benefits in kind through PAYE each payday. For more details review the HMRC website at: https://www.gov.uk/guidance/paying-your-employees-expenses-and-benefits-through-your-payroll

In summary this option increases the employees ‘taxable pay’ to include the benefit in kind rather than the HMRC reducing the employees tax code and avoids the need, in some circumstances, to submit a P11D.

From 17/18 you now have the option to record company car details against a nominated benefit in kind. Recording these details is optional currently, even if you have chosen to payroll Benefits in Kind, though is likely to become mandatory in the future.

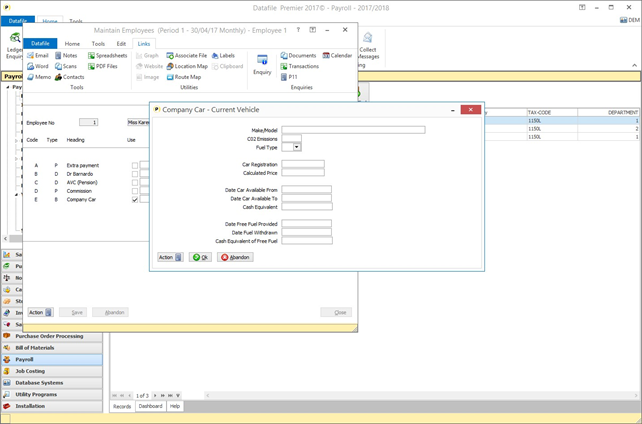

Employee Maintenance– either when adding new employees or via the Switches maintenance screen. When an employee is confirmed as using the

Company Car BiK switch a pop-up screen will allow recording of the company car

details.

Details prompted will be familiar to those used to recording these details on line via the HMRC website. If a car is withdrawn / replaced during the tax year you should update the withdrawal dates and create a new entry for the new car – up to four changes of car are supported for the employee within the tax year.

Installation

Payroll System Profiles

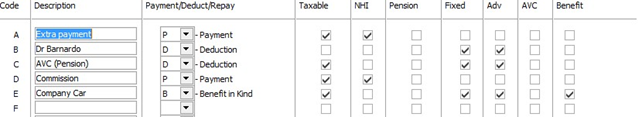

Within the Payroll System Profiles Payment and Deduction Table you can flag an extra payment switch as

being a Benefit in Kind.

if you have a Benefit in Kind switch which is used for Company Car’s note the letter (number) and then set this

|

Attachments

There are no attachments for this article.

|

General Document Design

Viewed 2439 times since Wed, Mar 27, 2013

End of Year P60 (P14) - Document Design Manager

Viewed 3009 times since Wed, Mar 27, 2013

HMRC Submission Viewer

Viewed 670 times since Tue, Oct 22, 2024

Standard Reports & Payslips

Viewed 2187 times since Wed, Mar 27, 2013

Employee-3 File Database Structure

Viewed 2529 times since Wed, Mar 27, 2013

STAT – Statutory Payment Details

Viewed 1378 times since Tue, Mar 26, 2013

Using the HMRC DPS Mailbox

Viewed 13942 times since Tue, Mar 26, 2013

Payments and Deduction Table

Viewed 2637 times since Tue, Mar 26, 2013

Employee Optional 3/11

Viewed 2452 times since Wed, Mar 27, 2013

AMEND – Amend Existing Employee Details

Viewed 1479 times since Tue, Mar 26, 2013

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|