Have you updated the nominal ledger? If yes then any re-run in payroll will result

in changes in the nominal ledger. You

will need to reverse the previously updated journal so you can re-post with the

corrected values.

Have you printed the payslips and sent to the employees? If yes then you

don’t need to reprint all the payslips – just the payslips of the employees in

question. You can use selection criteria

when printing the payslip so you just print for selected employees.

Have you submitted the FPS to the HMRC?You can resubmit an FPS to the HMRC for the current period. When you submit the FPS if we detect that it

has already been submitted we will warn but you can use the F7 option key to

override and continue.

Have you uploaded your payments file to the Bank? If yes then you have to check if you can

cancel this file and re-upload or, if the correction is in the employee’s

favour, whether you can make an extra payment.

If the correction results in a reduction in the employee’s net pay this

may be an adjustment you need to consider making to the next employee payment

upload.

Have you uploaded your Pension Contributions? If yes then you have to check if you can cancel this file and re-upload or, if you need to note the changes in employee / employer contributions for manual adjustment on the next periods upload.

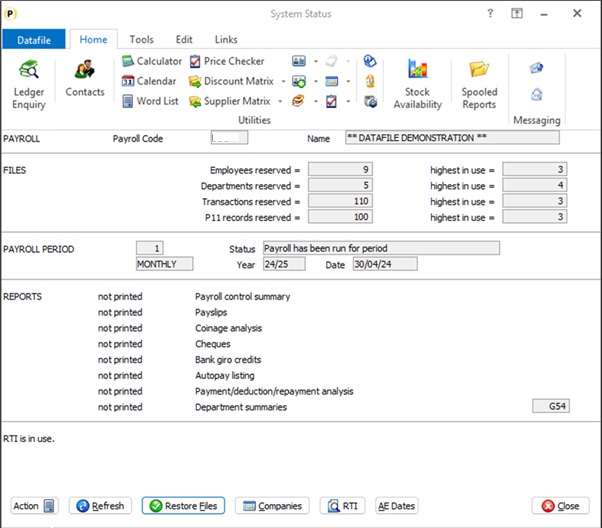

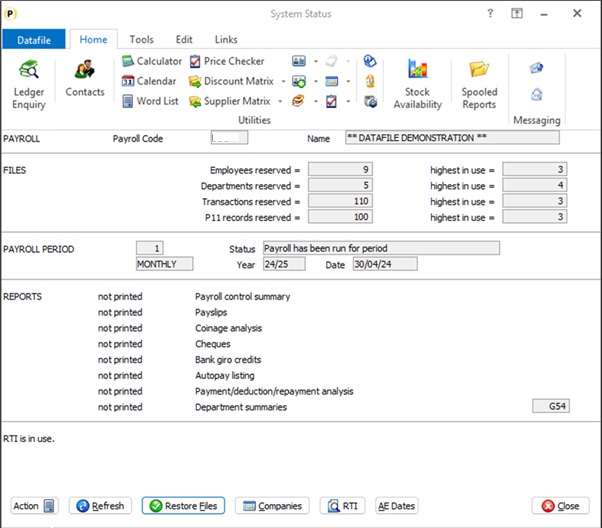

If you’re happy to restore the payroll then you can do so via the System Status option within the Payroll provided you have not submitted the FPS. Once you’ve submitted the FPS you can still restore but you have to do this via the Controls & Audit Manager for Payroll

Article ID: 2418

Created On: Thu, Aug 21, 2025 at 9:08 PM

Last Updated On: Thu, Aug 21, 2025 at 9:08 PM

Online URL: https://kb.datafile.co.uk/article/payroll-faq-correcting-payroll-errors-2418.html