From 1st January 2021, if your business is registered for VAT in the UK you will be able to account for import VAT on your VAT return for goods you import into:

![]() Great Britain (England, Scotland, and Wales)

from anywhere outside the UK

Great Britain (England, Scotland, and Wales)

from anywhere outside the UK

![]() Northern Ireland from anywhere outside the UK

and EU

Northern Ireland from anywhere outside the UK

and EU

Accounting for import VAT on your VAT return means you can declare and recover import VAT on the same VAT return, rather than pay it upfront and recover it later. The normal rules about what VAT can be reclaimed as input tax still apply.

You can account for import VAT on your VAT Return if:

![]() The goods you import are for use in your

business.

The goods you import are for use in your

business.

![]() You include your EORI number starting with ‘GB’

on your customs declaration.

You include your EORI number starting with ‘GB’

on your customs declaration.

![]() You include your VAT Registration No on your

customs declaration (if needed).

You include your VAT Registration No on your

customs declaration (if needed).

An online monthly statement will be available from the HMRC to download and keep for your records.It will show the total import VAT postponed for the previous month which you need to include on your VAT Return.To include on your VAT Return you need to complete the following boxes on your VAT Return.

Box 1 Include the VAT due in this period on imports accounted for through postponed VAT accounting.

Box 4 Include the VAT reclaimed in this period on imports accounted for through postponed VAT accounting.

Box 7 Include the total value of all imports of goods included on your online monthly statement, excluding any VAT.

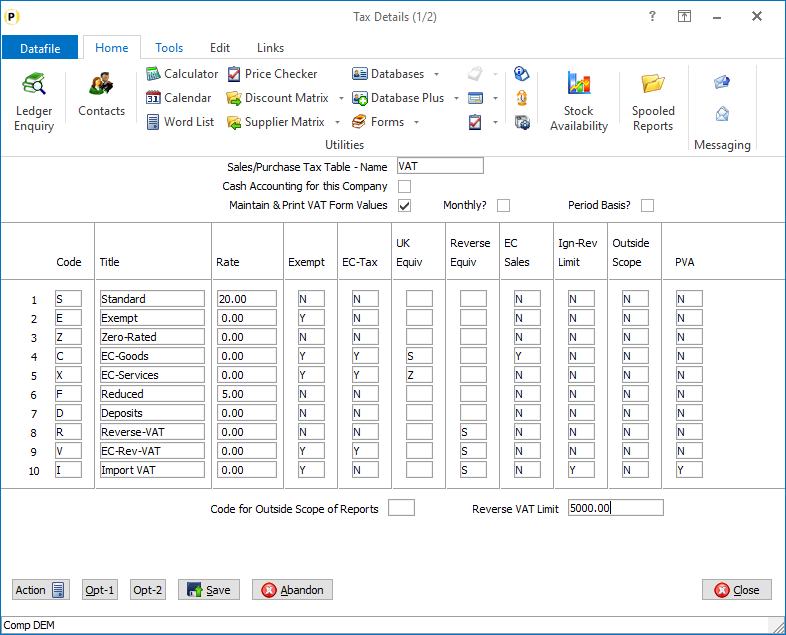

A new VAT code is required to identify VAT transactions processed under postponed VAT accounting and a new parameter has been added to the VAT table.

Code – set the code to be used for Import VAT. We have used ‘I’ here but can use any character.

Title – set the title to be displayed, for example, ‘Import VAT’.

Rate – set the rate to 0.

Exempt – set the flag to Y (if set on a supplier this VAT code will override any picked up from Stock)

EC Tax – set this flag to N

UK Equivalent – leave this blank

Reverse Equivalent – set this to main UK tax code (i.e., S)

EC Sales – set this to N

Ignore Reverse VAT Limit – set this to Y

Outside Scope – set this to N

PVA – set this to Y

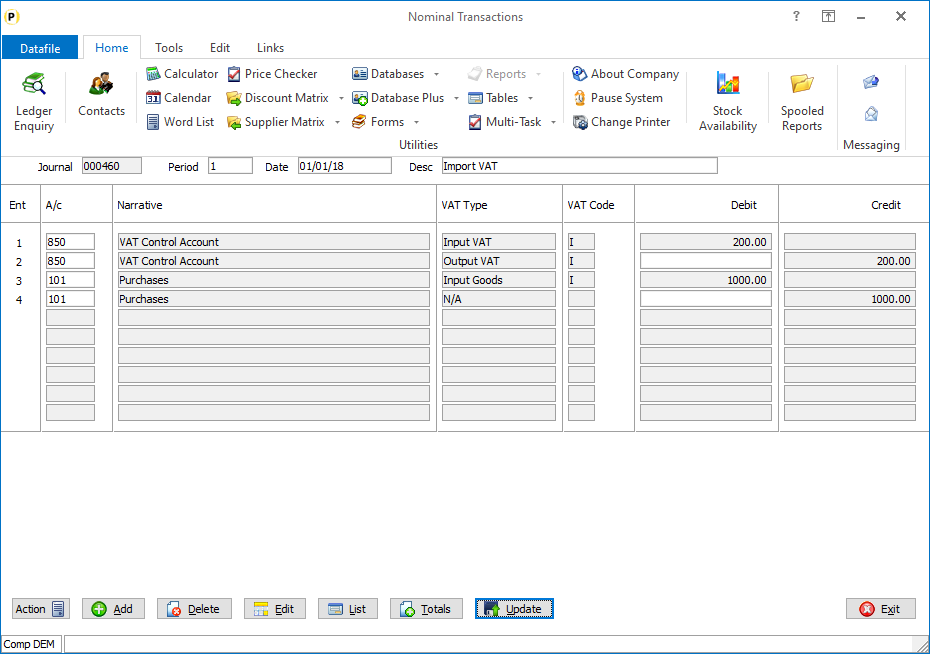

If posting the Import VAT from your online statement you can use the Nominal Journal postings.

For the example here we have assumed that your Import VAT is for £1000 worth of goods and £200 for VAT. Your supplier invoice has already been posted using an Out-of-Scope VAT code to your Purchases nominal code.

The first entry updates the VAT Form Box 4 value with the VAT reclaimed in this period on imports accounted for through postponed VAT accounting.

The second entry updates the VAT Form Box 1 value with the VAT due in this period on imports accounted for through postponed VAT accounting.

The third entry updates the VAT Form Box 7 value with the total value of all imports of goods included on your online monthly statement, excluding any VAT.

The fourth entry reverses the original supplier invoice posting.

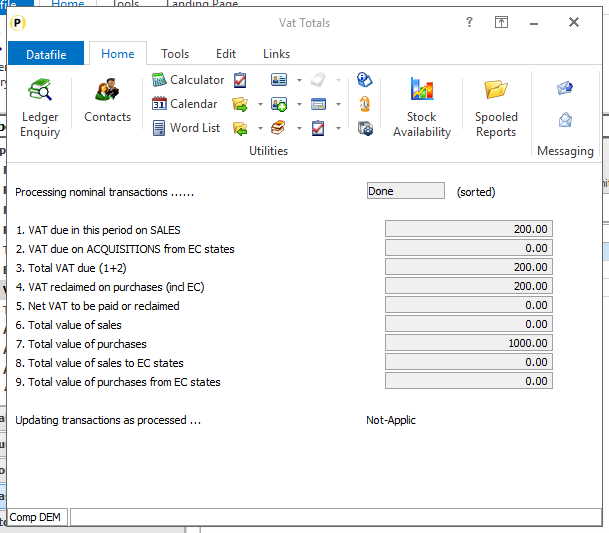

When you submit your VAT Form 100 then this would be updated as:

Generally, if using the online statement to update your VAT return your supplier invoices would be posted under an ‘Out-of-Scope’ VAT code.

The nominal journal posting would then declare the Import for VAT purposes. Any duty invoices would be posted using standard VAT as usual, but they would no longer include import VAT entries.

You can, however, use the Import VAT as part of your supplier invoice postings – this will update boxes 1, 4 and 7 on the VAT Form as per the nominal journal above. You may still need to post manual adjustments due to ‘timing’ issues between your supplier invoice updating and your HMRC online statement.

The use of the Import VAT tax code is restricted to suppliers with a non-GB EC Country Code.If you attempt to use an Import VAT tax code for a UK supplier, you will be warned accordingly.

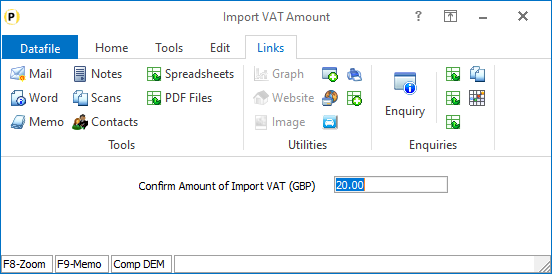

Otherwise for direct entry in the Purchase Ledger or Supplier Invoices in Purchase Invoice entry then after confirming the VAT code you will be prompted to confirm the amount of Import VAT.

For Purchase Order Processing when raising the supplier invoice the Import VAT will be calculated and updated automatically but if confirming VAT on a line-by-line basis you will also be prompted to confirm the Import VAT. Regardless of the currency of the supplier the Import VAT would be calculated / entered in GBP.

Article ID: 2262

Created On: Tue, Oct 15, 2024 at 10:54 AM

Last Updated On: Tue, Oct 22, 2024 at 3:58 PM

Online URL: https://kb.datafile.co.uk/article/postponed-vat-accounting-2262.html