Payroll users will be familiar with the process where each payroll run an online Full Payment Submission (FPS) is processed to the HMRC. For VAT, however, users have typically recorded the details online via the HMRC website – in Datafile 2018 a similar process to the Payroll FPS in now available to submit the VAT Form 100.

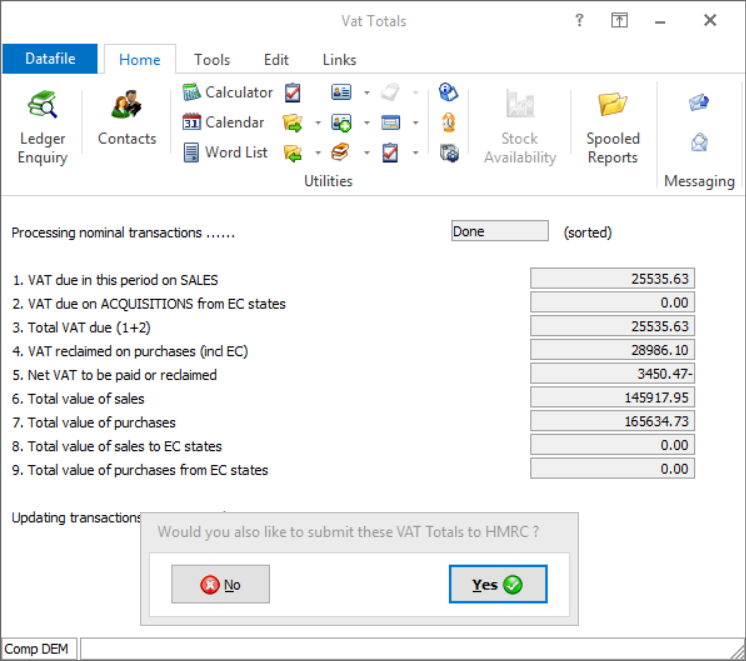

You can run the VAT Form 100 for review multiple times – when reviewing you will be offered the opportunity to make a test submission - but when ready to finalise a parameter is available to ‘Update Files After Printing’. When you confirm this you will be prompted if you wish to submit the VAT totals to the HMRC.

If ‘No’ then the system will not apply the ‘update files’ parameter so you can reprocess later. If ‘Yes’ then the system will create the usual VAT Form 100 print and audit trail before moving to the submission procedure.

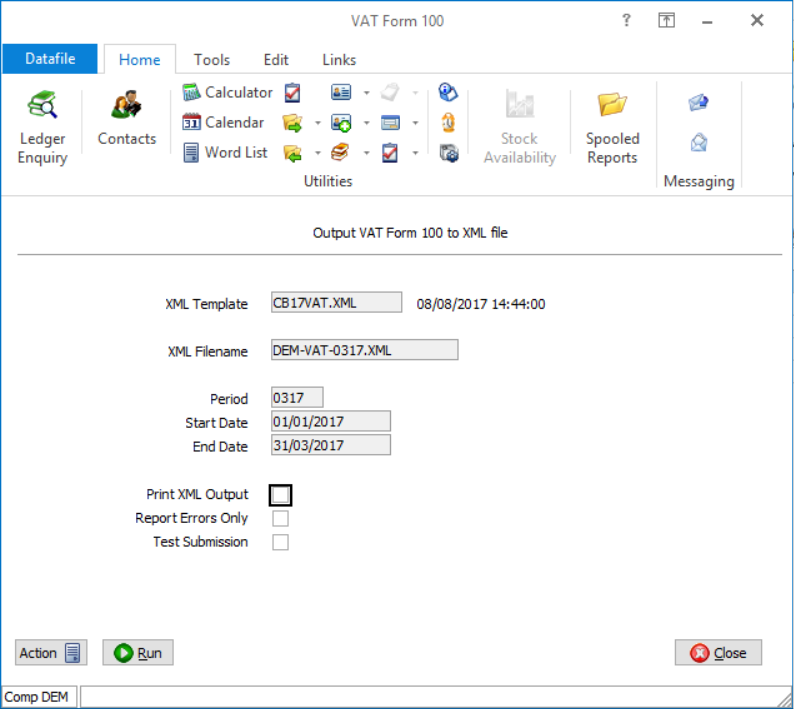

Print XML Output – this option creates a printed report of the XML submission to the HMRC. Set as required.

Report Errors Only – only applicable if printing the XML, you typically not set this option.

Test Submission – set automatically for you based on whether you have confirmed to ‘update files’ or not as part of the initial VAT Form 100 parameters.

Select RUN to being the submission process – you will be prompted to confirm you are sending a TEST or LIVE submission as appropriate before being prompted to commence output. The system will perform an integrity check on the created XML file and, if all OK, you can choose to proceed with the submission.

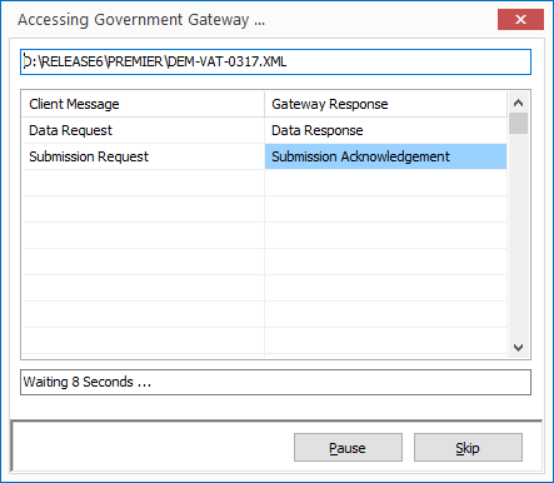

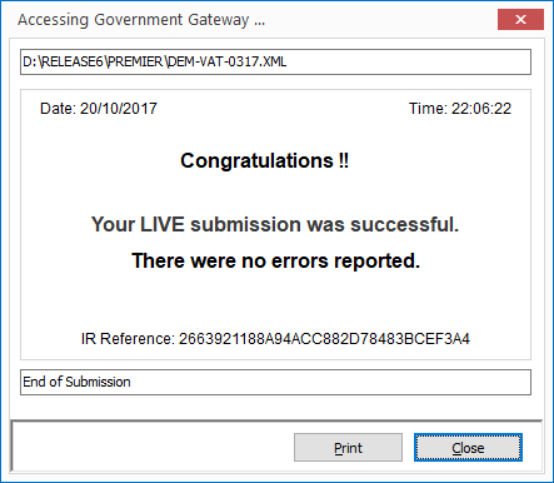

The system will then proceed with the typical HMRC handshakes of Data and Submission requests before receiving an acknowledgement of the transmission.

Where the submission was successful you can then print a submission receipt if required.

Installation

System Profiles

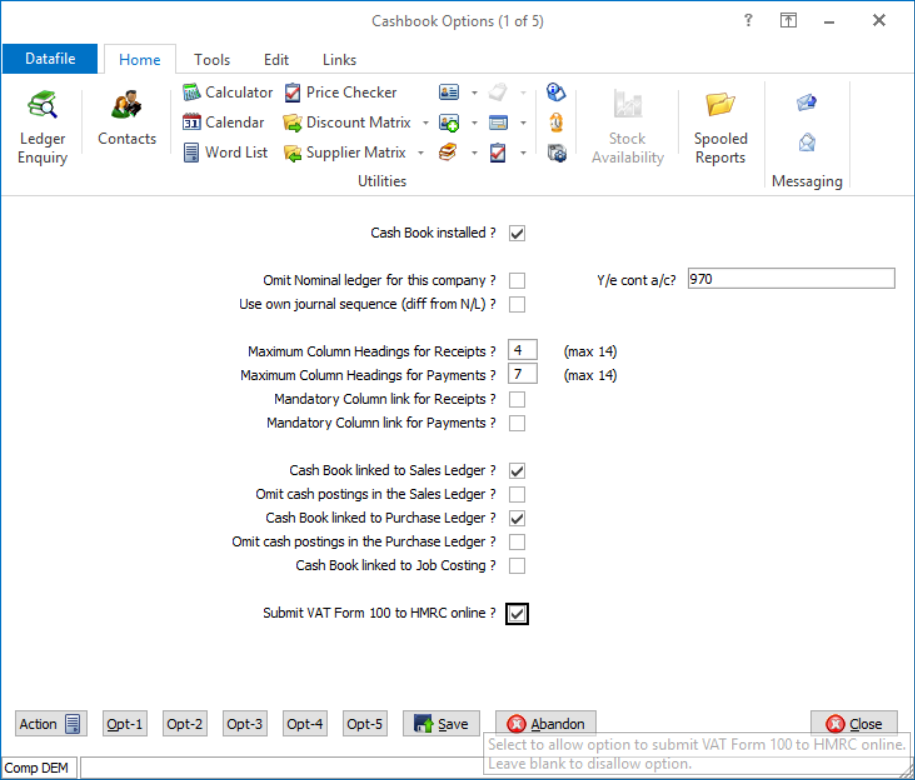

The parameters to enable the facility to send VAT Form 100 online are available within the Cashbook System Profiles.To update select Installationfrom the main menu and Lock Out All Systems. Lock out the system and then select System Profiles and Cashbook.

Parameter Screen 1 prompts for whether you wish to submit the VAT Form 100 online.

Submit VAT Form 100

to HMRC online – set to yes to enable this facility.

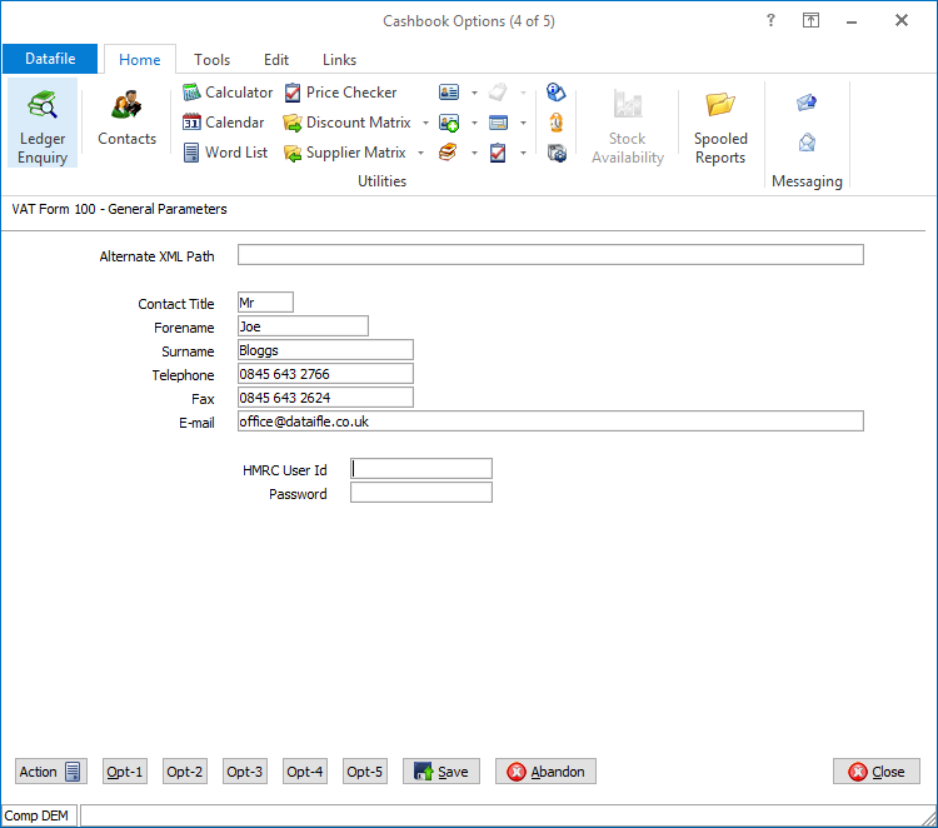

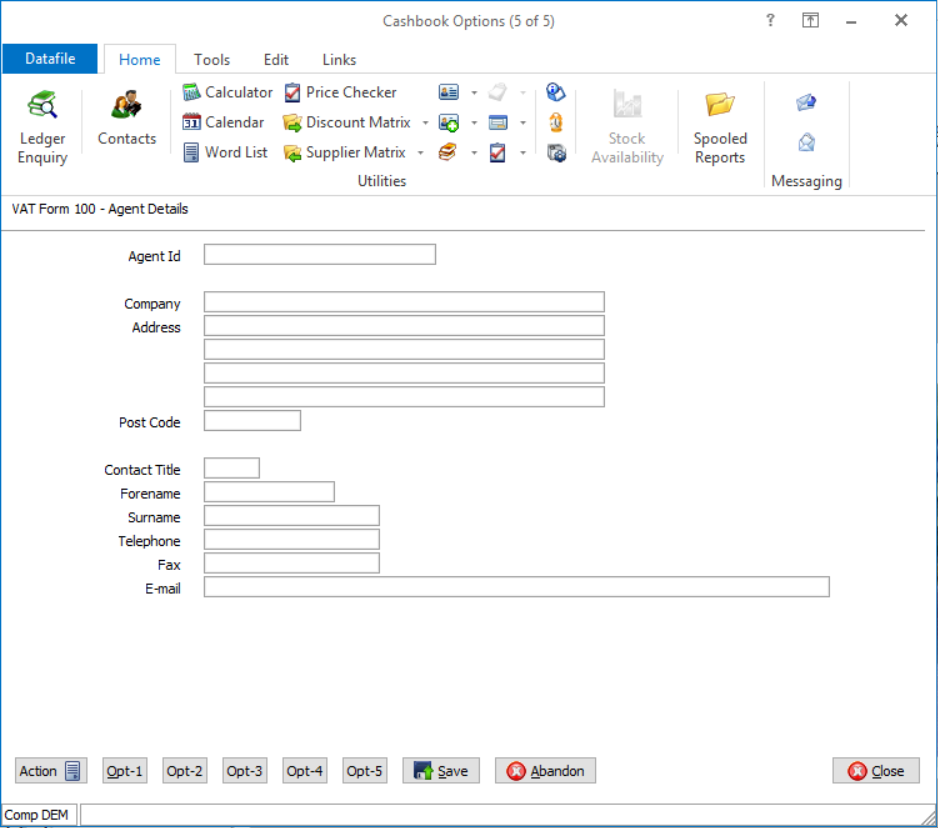

Parameter Screens 4 and 5 allow for the recording of company and agent contact details.

Alternative XML Path – communication files are saved within the main Datafile folder with the live and test submission files saved in a CBtaxyearfolder off this location. This option allows you to reference an alternate location for these files.

Contact Details – record the contact details to be used on the submission to the HMRC

HMRC User ID / Password – enter your HMRC (Government Gateway) User Id and Password.

Where acting as an Agent and submitting details on behalf of another company enter your agent details here.

Set Company Details

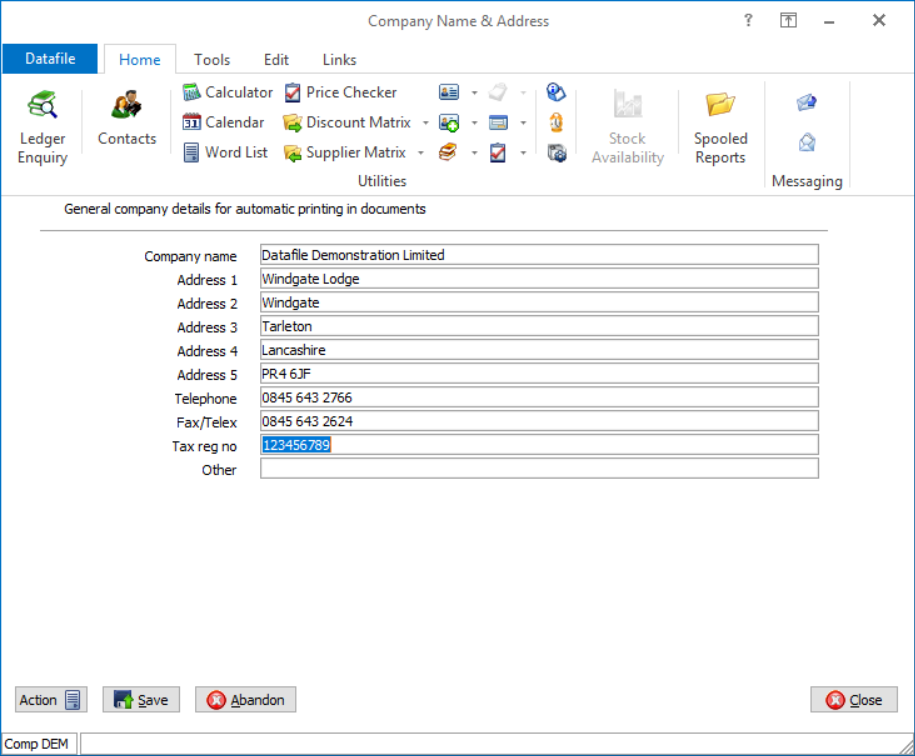

The VAT Registration No used is defined within the Set Company Details parameters as the Tax Reg No. You should ensure this is formatted to only contain the numbers for the VAT Registration – no spaces and no GB prefix.

Menu Design

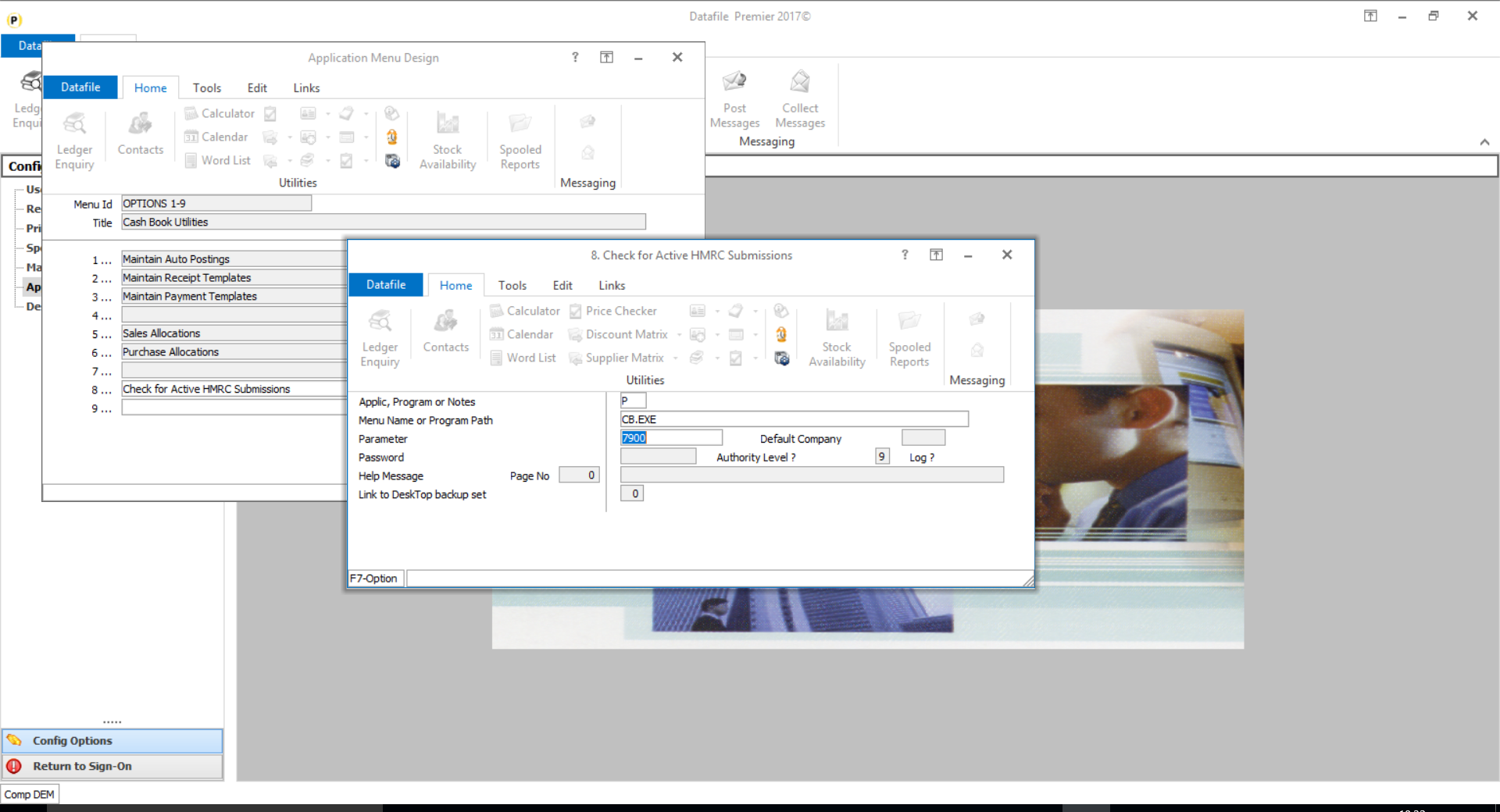

There can be times when the Government Gateway is busy and not sending submission receipts promptly. At these users can choose to SKIP waiting for the response and check again later. A new Cashbook Utility option is available so that you can check the status of these submissions.

To add this menu sign on as the CONFIG user and select Application Menu Design and amend the CBUTIL.D03

App, Program or Notes – P-Program

Menu Name or Program Path – CB.EXE

Parameter – 7900

Other options can be set as required.

Article ID: 2220

Created On: Mon, Mar 2, 2020 at 4:49 PM

Last Updated On: Mon, Jun 19, 2023 at 6:22 PM

Online URL: https://kb.datafile.co.uk/article/vat-form-100-online-submission-2220.html