| Home » Categories » Multiple Categories |

VAT Adjustments - VAT on Imported Goods |

|

Article Number: 2214 | Rating: Unrated | Last Updated: Mon, Jun 12, 2023 at 2:36 PM

|

|

VAT on Imported Goods

When goods are purchased from a country outside the EU then import VAT may be applied. Typically, a separate invoice is supplied from the courier showing the amount of import duty and VAT due.

1. In Receipt of Form C79 when Posting

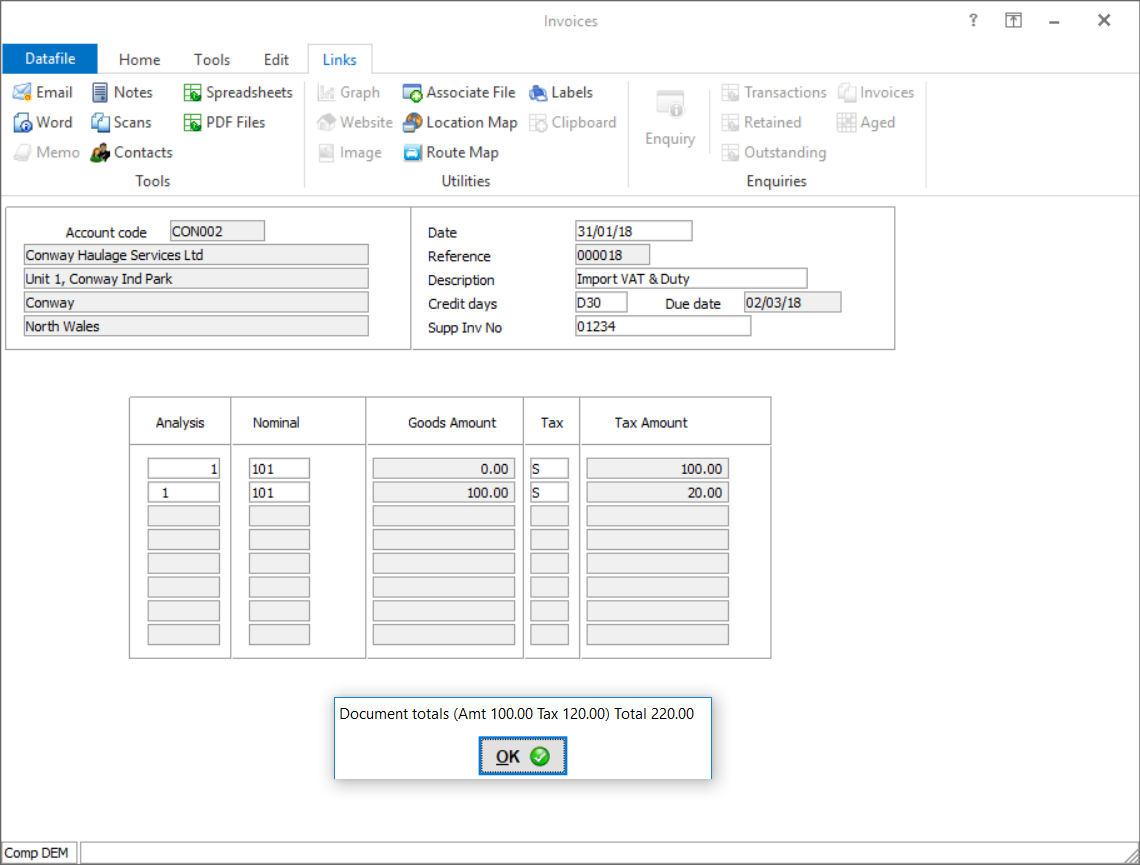

If you have received form C79 at the point of posting the courier invoice you can claim the Import VAT directly.

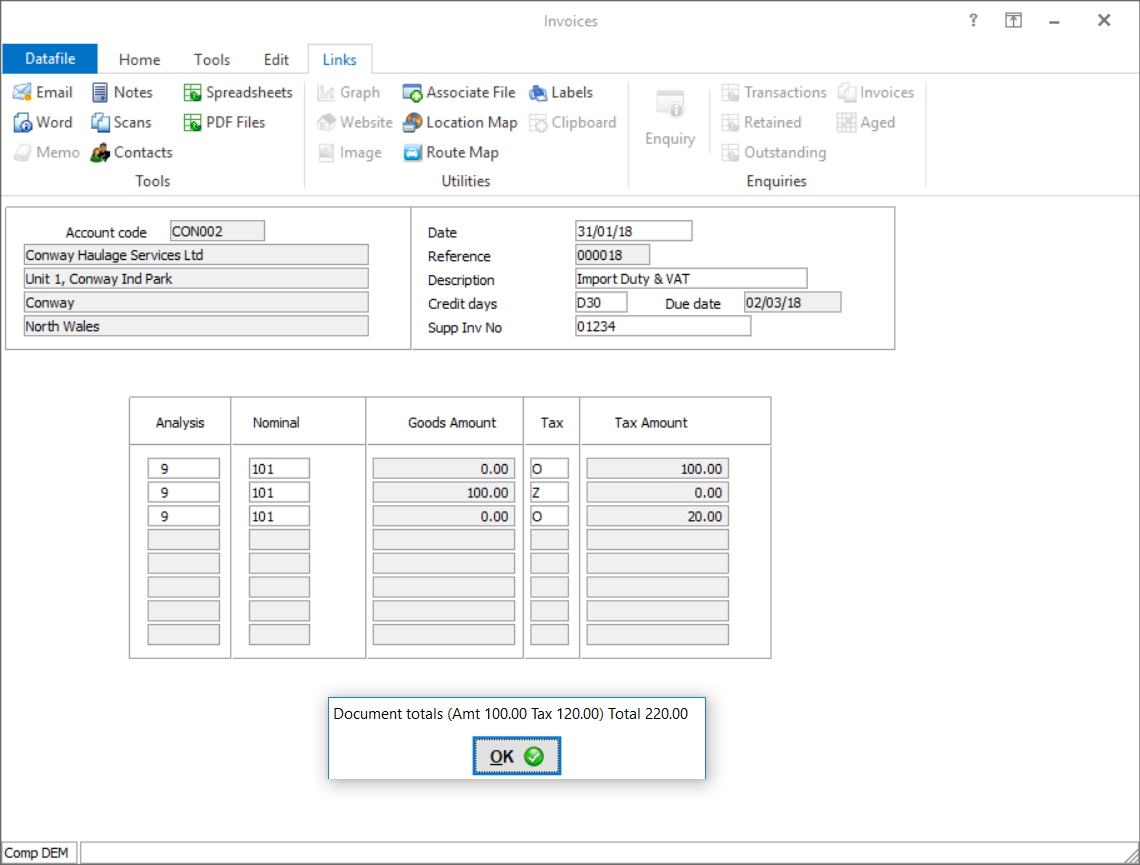

2. Not In Receipt of Form C79 when Posting If you there’s no corresponding form C79 at the point of posting, you cannot initially claim the Import VAT so the invoice should be posted accordingly using Out of Scope VAT codes where appropriate.

The use of the Out of Scope VAT code prevents the VAT being reclaimed on your VAT Form 100 for Import VAT and Duty.

3. Form C79 Form Received After Posting

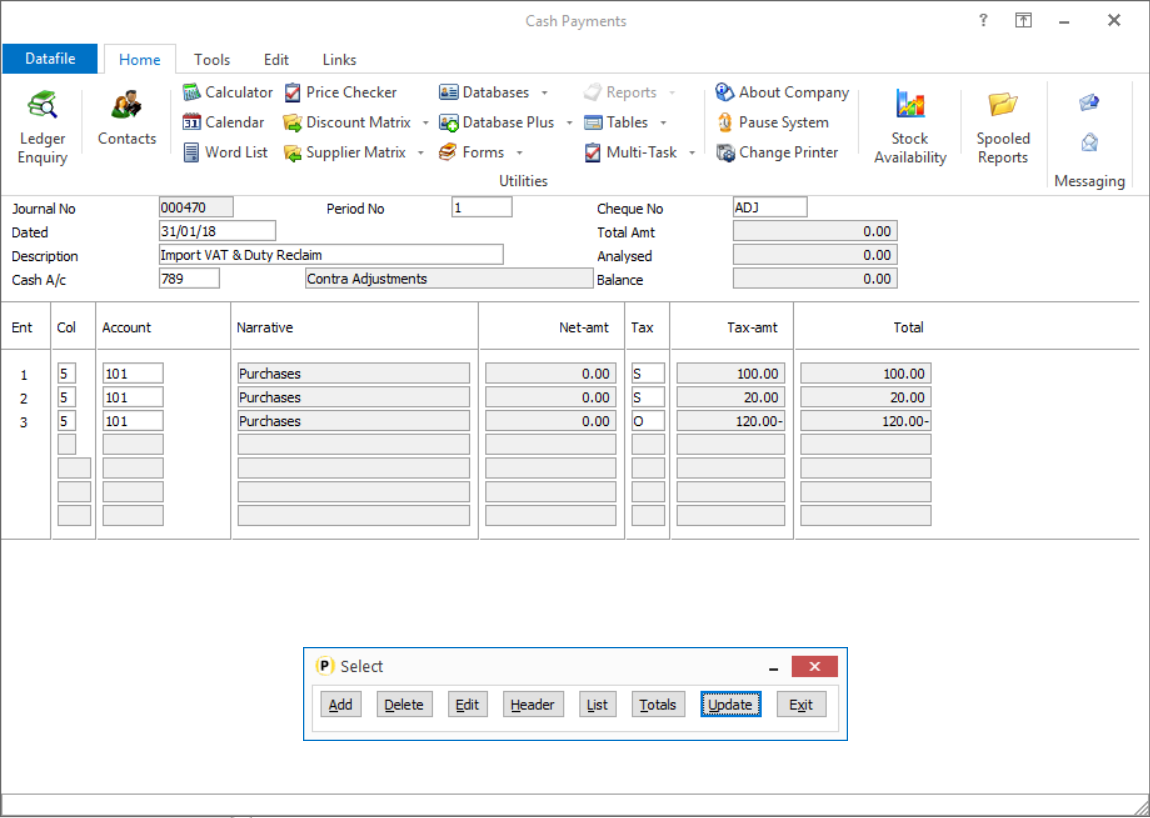

If you later receive your C79 certificate you can reclaim the Import and Duty VAT using the Cashbook Payment option.

In the Cash A/C box, select the Contra / Adjustments account and enter a zero value in the Total-Amt box.

On line 1 select the relevant expense account, then enter the Import VAT value as zero in the Net-Amt box, the relevant VAT code in the Tax box, and the actual reclaimed VAT amount in the Tax-Amt box.

One line 2 repeat the process for the reclaimed Duty VAT.

One Line 3 Reverse the Out of Scope Purchase Invoice posting by selecting the expense account, entering the Out of Scope VAT code and then setting the VAT amount as the negative equivalent of the Import and Duty VAT. |

Attachments

There are no attachments for this article.

|

Ledger Enquiry Manager - Nominal

Viewed 2004 times since Wed, Jun 27, 2012

Authority Levels for Marking Accounts on Stop / Suspended

Viewed 2284 times since Fri, Jun 8, 2012

Additional Copy Items from Stock to Order Detail

Viewed 1926 times since Fri, Mar 11, 2016

Turnover History Report

Viewed 3895 times since Mon, Jun 11, 2012

Account Authority Levels

Viewed 3117 times since Tue, Jun 12, 2012

Trans Optional 2 - Database Profiles

Viewed 2376 times since Mon, Jul 2, 2012

Automatic Payments – Set Transaction Description from Account

Viewed 310 times since Wed, Oct 16, 2024

Copy Notice for Invoice Reprints (Sales Ledger)

Viewed 2213 times since Mon, Jul 2, 2012

Validate Invoice Entry against Job Budgets (P/L only)

Viewed 2497 times since Wed, Jun 13, 2012

System Profiles Screen 5 (excluding Compact)

Viewed 2227 times since Mon, Jul 2, 2012

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|