| Home » Categories » Multiple Categories |

VAT Adjustments - Partial VAT Exemption Scheme |

|

Article Number: 2211 | Rating: Unrated | Last Updated: Mon, Jun 12, 2023 at 2:20 PM

|

|

Partial VAT Exemption Scheme (VAT Notice 706) A business is partially exempt if it makes, or intends to make, both taxable and exempt supplies and incurs tax on costs that relate to both. If your business is partially exempt, then you may not be able to recover all your Input VAT.

To adjust your VAT return to reduce the amount of Input VAT that can be reclaimed you can post a Cashbook Payment.

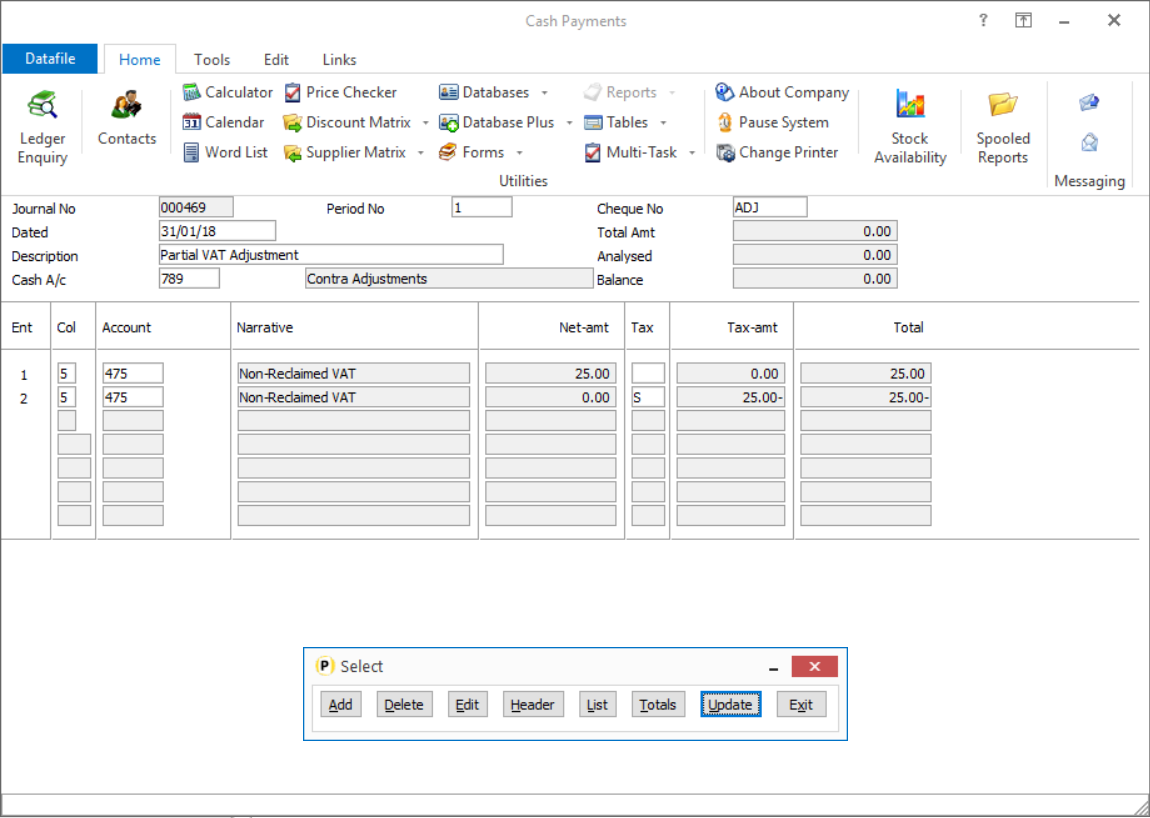

As per the screenshot above, post the Cashbook Payment using your Contra Adjustments account and set the total payment value as 0. For line 1 select your Non-Reclaimable VAT expense account and enter the net amount as the amount of VAT that cannot be reclaimed, leave the VAT code and VAT amount blank. For line 2 select your Non-Reclaimable VAT expense account again, leave the net amount as zero, enter your standard rate VAT code, and enter the VAT that cannot be reclaimed as a negative value.

|

Attachments

There are no attachments for this article.

|

Separate Look-Ups for Extra Maintenance Screens

Viewed 1560 times since Wed, Jun 13, 2012

BUDGETS – Budgets Proposed - Nominal

Viewed 863 times since Wed, Jun 27, 2012

Enter Invoice Adjustments

Viewed 1610 times since Mon, Jul 2, 2012

Record Groups as Items in Discount and Supplier Matrix

Viewed 2214 times since Fri, May 27, 2016

Transaction Summary

Viewed 1530 times since Mon, Jul 2, 2012

Display Debit / Credit Totals during Journal Input

Viewed 1293 times since Fri, Oct 26, 2012

Omit Statement Print for Flagged Accounts

Viewed 1629 times since Wed, Jun 13, 2012

Save Turnover and Cost Values for Previous Years

Viewed 1388 times since Fri, May 27, 2016

Transactional Optional 1 - Nominal - Database Profiles

Viewed 1292 times since Thu, Jun 28, 2012

System Profiles

Viewed 1619 times since Mon, Jul 2, 2012

|

| Datafile Home | KB Home | Advanced Search |

|

|

|

|

|

|

|

|